A Biased View of Estate Planning Attorney

A Biased View of Estate Planning Attorney

Blog Article

All about Estate Planning Attorney

Table of Contents10 Simple Techniques For Estate Planning AttorneyThe Buzz on Estate Planning AttorneyThe Facts About Estate Planning Attorney RevealedEstate Planning Attorney - An Overview

If you obtain long-term care or other services through Medicaid, the Medicaid Recovery program might look for payment by declaring a few of your estate, like your house, after you die. A strong estate strategy will safeguard your properties and enable you to hand down as a lot of your estate as feasible.

It sounds tedious however it's crucial to speak with all your possibility legal representatives, because estate planning is a personal process. Will you send me updates on my estate plan in the future or is this an one-time service? If you're working with an estate lawyer from a large law firm, it's important to know if you will certainly work specifically with one individual.

8 Simple Techniques For Estate Planning Attorney

Try to speak with individuals who have actually collaborated with the lawyer, like their customers and even an additional attorney. Lawyers that are challenging to collaborate with or who treat individuals poorly will likely establish such a reputation swiftly with their peers. If necessary, have a follow-up conversation with your possible estate lawyer.

When it concerns guaranteeing your estate is intended and managed appropriately, hiring the best estate preparation lawyer is important. It can be risky to make such a large choice, and it is Read Full Article essential to recognize what inquiries to ask them when thinking about a law practice to manage your estate intending project.

You'll ask about the devices readily available for comprehensive estate plans that can be tailored to your special situation. Their qualifications for practicing estate planning, their experience with unique research study jobs connected to your particular project, and how they structure their settlement models, so you have appropriate assumptions from the start.

The 8-Minute Rule for Estate Planning Attorney

It is necessary to note that estate preparation records are not simply for affluent people; everyone needs to take into consideration contending least a basic estate strategy in position. With this being stated, it's vital to comprehend what responsibilities an estate preparation lawyer has to ensure that you can click over here now find one that satisfies your one-of-a-kind demands and objectives.

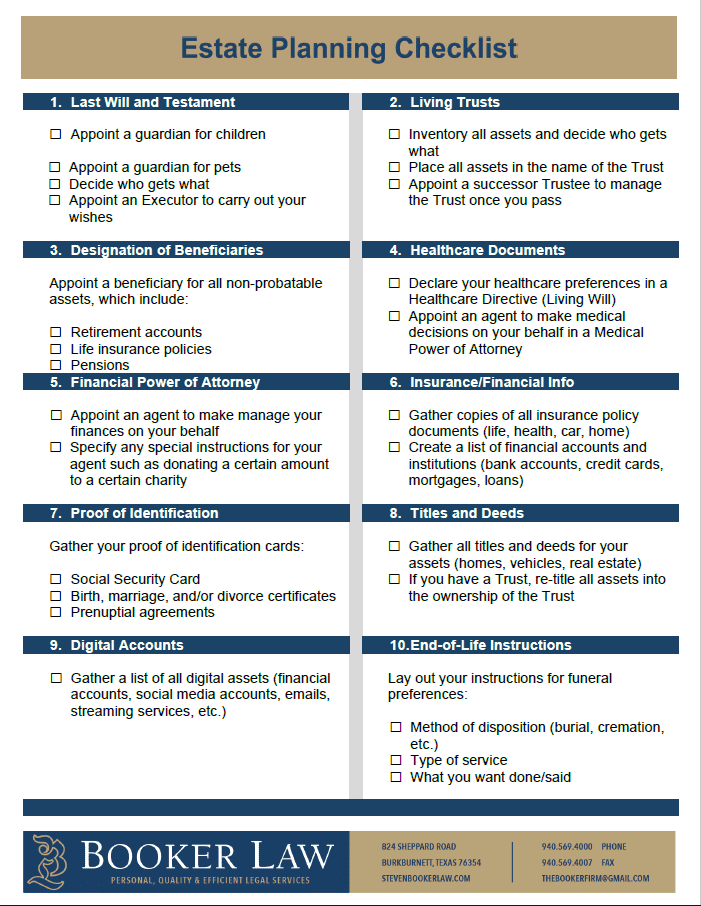

This entails assisting the client recognize their possessions and obligations and their wishes pertaining to the circulation of those possessions upon death or incapacitation. The estate planning attorney will certainly evaluate any kind of existing files that the client might have in area, such as wills, counts on, and powers of lawyer, to ensure they are up-to-date with state laws.

On top of that, the estate planning lawyer will certainly collaborate with the client to click to find out more assess their tax scenario and suggest methods for reducing tax obligations while likewise accomplishing the desired goals of the estate strategy. An estate planning lawyer need to be spoken with whenever there are any kind of changes to a person's economic scenario or household framework, such as marital relationship or divorce - Estate Planning Attorney.

With all these responsibilities in mind, it is essential to comprehend what credentials one ought to try to find when choosing an estate organizer. When selecting an estate preparation lawyer, it is essential to guarantee that they are qualified and experienced. Several estate preparation attorneys have actually years of specialized training in the field and experience functioning with customers on their estate plans.

The Greatest Guide To Estate Planning Attorney

Experience and proficiency are key when selecting an estate planning lawyer, yet there are various other factors to consider. Some lawyers might specialize in specific areas, such as elder law or organization sequence preparation, while others may be much more generalists. It is also important to consider the references provided by the lawyer and any kind of evaluations they have received from previous customers.

This will certainly allow you to recognize their character and experience level and ask inquiries about their practice and strategy to estate preparation. By asking these inquiries upfront, you will certainly much better understand just how each attorney would certainly handle your scenario before committing to function with them on your estate plan. You need to ask the right questions when selecting an estate planning attorney to guarantee that they are the most effective fit for your demands.

When choosing an estate preparation attorney, it is very important to comprehend what kinds of services they use. Inquire about the lawyer's specific estate planning solutions and if they can create a personalized estate strategy customized to your requirements. Additionally, ask if they have experience creating living depend on documents and other estate preparation instruments such as powers of attorney or healthcare instructions.

Report this page